Too Much Fear & The Golden Breakout

What it is:

Silver, Gold, Oil, Miners(XME), Pure Value(RPV), and Rare Earth Metals

Focus on short duration equities that have strong cash flow yield (RPV)

We have a $110-115 on Oil. Environmental policies, geopolitics and worthless “ESG investing” have been leading to a shortage of oil and gas.

SHORT on publicly-traded private equity stocks (KKR, BX, CG). Topped.

LONG the Activision buyout

VIX is too high for no war. Add Nasdaq on serious weakness (-3%)

Bitcoin is trading just like the Nasdaq, for now.

If bombs start flying, we start buying.

Russia just snapped. All equity correlations go towards 1 in a market shock. Investors trade into higher quality names and the remaining froth centralizes. The same thing happened in the 2017 crypto top and today. Bitcoin and Ethereum will still reign supreme (easy pair trade). If you are trading one asset class then you are trading blind. Focus on Gold, Rare Earth Metals and oil breaking out to new highs. The companies that are winning are those who integrate their own supply chains. Bitcoin is trading like the Nasdaq.

S&P 500: Important Levels To Watch

The Gold Breakout

Even Putin is waiting for the breakout in Gold

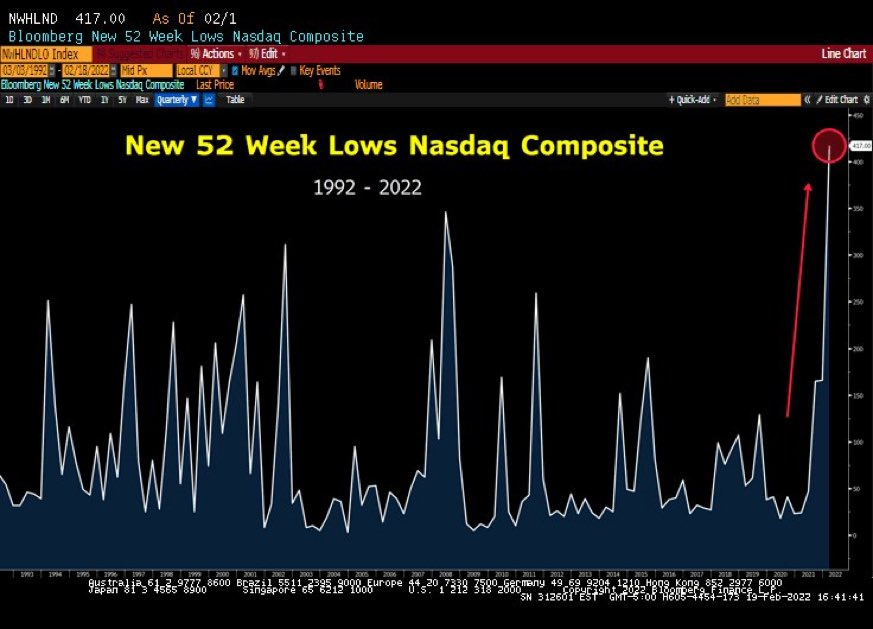

This Chart Is Gold Too

The Nasdaq at its worst right now.

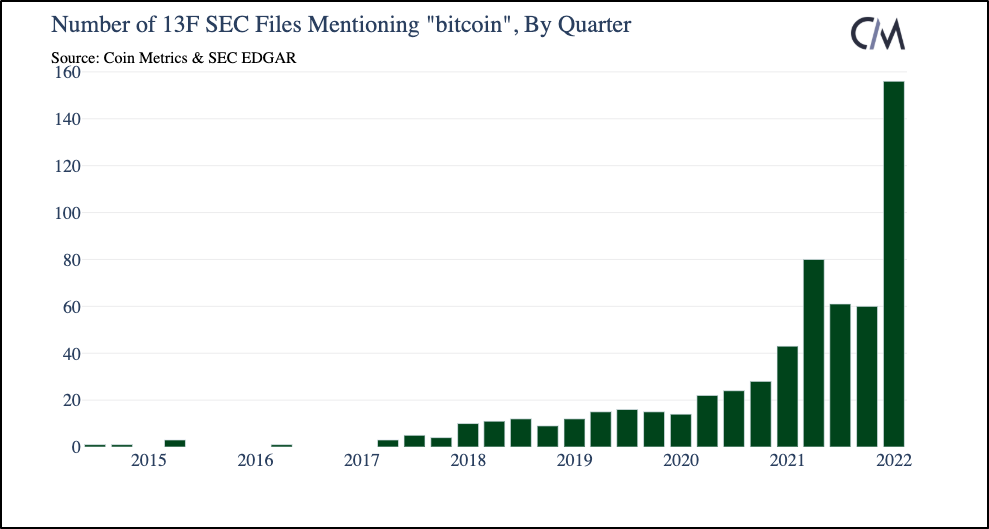

Bitcoin Trades Like Equities For Now

Bitcoin STILL Very Relevant

Do you even remember the top ten from the 2017 top?

Our Ten Commandments

Return always wants its risk payment.

Timing is everything

Trading only one asset class is blind

Harder you work, luckier you get

Investment is a trade gone wrong

Be the dumbest person in the room

Busy people always finds time

Manage the draw-downs and compound the returns

There’s always someone smarter on the other side of the trade

If you don’t combine asset allocation, trend & momentum following, macro and tail hedging strategies in your long-term portfolios then good luck to you.

Not Investment Advice. For Entertainment Only