Timing is everything. Bonds are blasted. Inflation will be tamed.

Price action is what really matters. Fundamentals are always just a narrative.

Follow us on twitter @gmgresearch

Last week’s article:

Levels to watch: S&P 4400, QQQ 350, CORN 26.50, AMD 100, XME 60

Expect more volatility.

Mortgage rates broke a 40 year trend!

Utilities are extremely strong right now & cannot be overlooked

Commodities, our miners (XME) and precious metals are still strong

This week:

Bonds are getting blasted.

QQQ is starting to carve out a base but expect more volatility first.

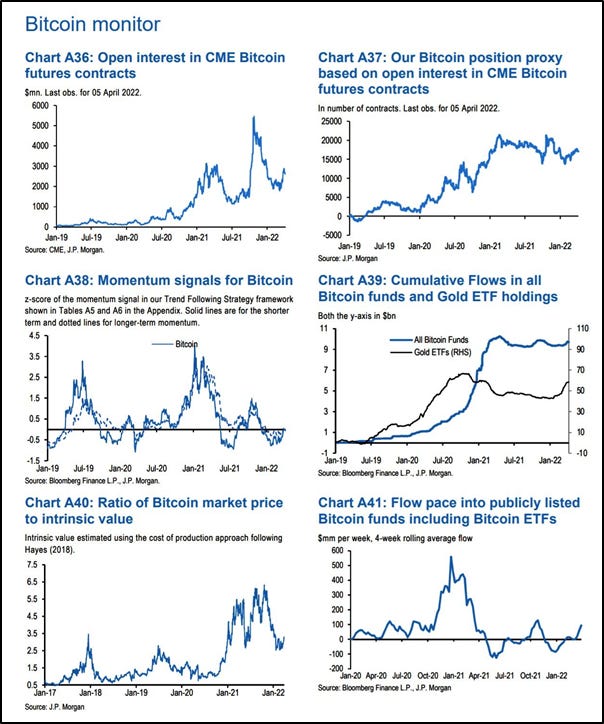

Bitcoin is right near $42,000. As we said, volume profile is the key indicator.

Remember, trading one asset class is trading blind.

On a serious down day (>2%), we like:

GSG, HYG at (5.5% yield), EWZ, QQQ, TGT, WMT and Bitcoin

Our February chart is still important today

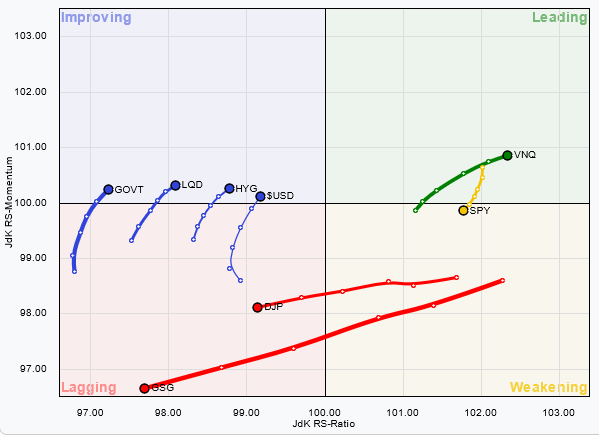

The relative rotation graph. Learn it.

Brazil has potential for a long-term breakout. Commodity play

GSG: Vol fell off and it is looking tight. Bullish on this still.

Bitcoin @ $42,000

Volume profile

Remember…

Return always wants its risk payment.

For entertainment only. Not Investment Advice.