First things first, too much bad news all at once is sometimes bullish for the market.

IT IS ALL ABOUT THE CONTROLLING NARRATIVE IN THE MARKET.

Here is the true narrative you need to know: Inflation will “calm down”. There has been HUGE month/month inflation numbers. BUT! In a few months, the YoY numbers will look relatively “much better” which will be the narrative that helps both equities and the fed (they wont be under as much pressure to raise rates more). Remember, most “investors” regurgitate the news like birds. All they need is a semi-positive inflation headline.

Quick points:

Consolidation is expected.

Something to note: The nominal yield curve is inverted, the real yield curve is upward sloping. This critical to understand. Inflation will be tamed. No matter the cost.

Surge in home prices will collapse under its own weight. (Higher mortgage rates)

We are starting this fed rate hike cycle with a flat yield curve. (Not normal at all)

Dimon made his case for energy independence on Monday during a closed-door White House meeting with 16 top executives. Oil spike protection team.

Stress in the repo market again: The 2Y completely collapsed on Friday, trading from a low of -2.75% to a high of .05%.

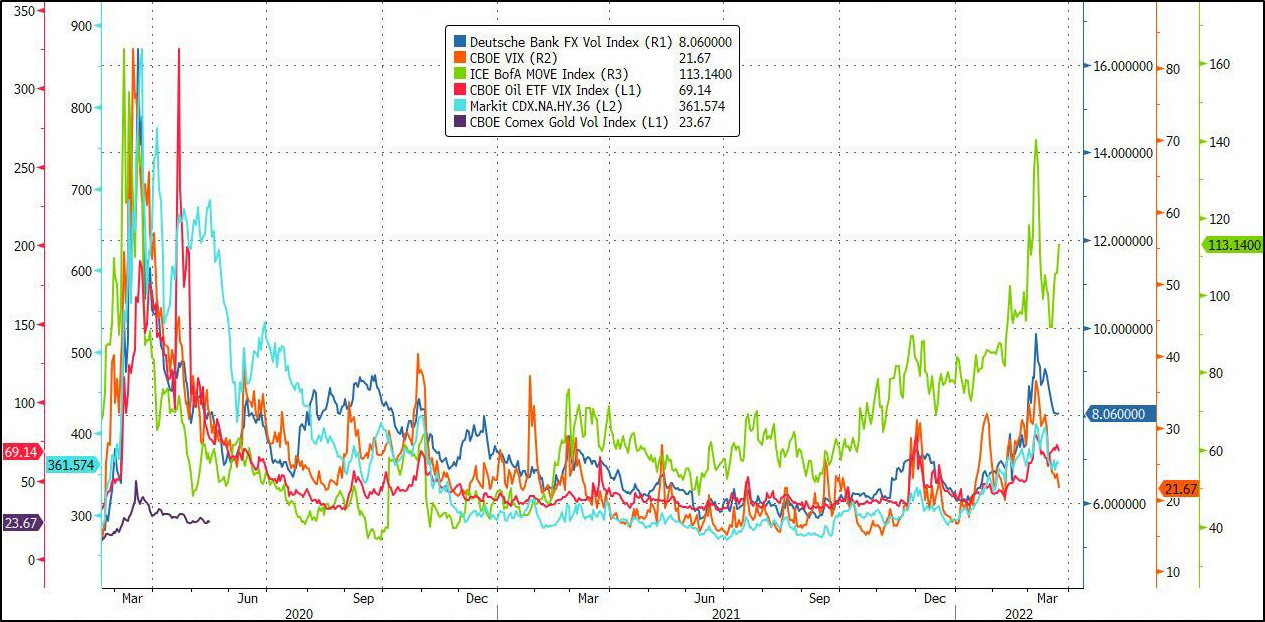

Bond volatility is getting out of control.

Look at this rip your face off rally in the Miners ETF we liked.

Learn a bit: VIX rule of 16

VIX consistently at +30 is too high to sustain. The rule of 16 is approximately the square root of 252 (the number of trading days in a year). When you divide any implied volatility (IV) reading (such as VIX) by 16, the annualized number becomes a daily number. Highest ever VIX was 80, it happened twice both in intense systemic events.

Fundamentals were always just a narrative. Price action matters most. Here is Amazon’s letter to shareholders in 2000.

Key Level: $42k. Volume profile is a great tool to use. Most “indicators” are worthless.

Ethereum isn’t “the rich people’s network”anymore. It needs to compete.

USD is already the reserve currency for stablecoins.

Return always wants its risk payment. Not Investment Advice.