We continue to be bullish heading into the new year, but are not chasing this rally (cash is still a position). Here is the quickest rundown you can get (feel free to email us with any further questions gmgmacroresearch@gmail.com):

QQQ needs to break above 400 & 4725 for the S&P 500 to continue the rally (figure 1 & 1.1)

The market went from extremely oversold to extremely overbought in ONE WEEK. The reversal of the reversal. Bullish (figure 2)

Tuesday’s 5% surge in semiconductors to recent highs offers a bullish backdrop for both the S&P and QQQ. China A-shares are also strong (3)

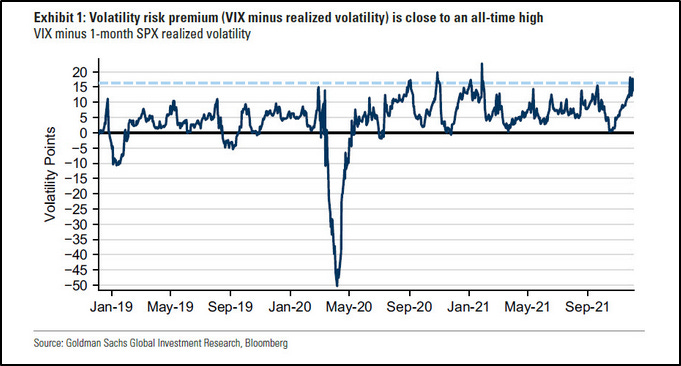

When volatility risk premium spikes, a $200B+ group of funds (managed volatility funds) crush the bid like no other.Bullish (figure 4)

A rotation is happening out of defensives (Utilities and REITs) and into the broader market (cyclicals/materials/industrials).

“Smart” money is adding exposure according to Charles Schwab (figure 5)

Some technical reasons:

Commodity Trading Advisors (CTAs) have officially flipped to re-levering

Gamma is long

Liquidity is better

Corporate cash levels are too high

Take a step back, the long-term S&P 500 trend is intact.

Now zoom in and see blast breakout we are about to have tomorrow.

Chinese A shares aka Emerging Markets in general are acting a lot better

Vol funds selling those expensive PUTS to those noob retail traders.

According to Goldman Sach’s systematic strats division: CTAs, risk-parity funds, vol control) have $25b of demand over the next 1-month assuming a flat tape and $60 billion worth of demand in an up tape. Bullish