Stress In The Funding Markets & The Precious Rally

It is time to start locking in all the excess outperformance from trash energy and turning focus to what really matters, risks in the funding market.

Our strategy continued to bode well into the volatility.

It is time to start locking in all the excess outperformance and turning focus to what really matters, risks in the funding market.

The controlling narrative:

There is complete panic buying to the upside in commodities/precious metals/zinc/aluminum/copper/rice/coffee/palladium/corn/soy/lean hogs etc. During times of extreme market volatility, correlations of certain asset classes move closer to 1 (all commodities). Mean-reverting funds will start to outperform once, meaning it is best to start looking at what hasn’t been working (Tech, Growth, Emerging Markets, China). We continue to see upside for metals (Gold, Silver, Uranium).

The commodity melt-up is pressuring the Fed to not raise rates as quickly (better for Growth).

FRA-OIS spreads (stress in the system) is expanding. A must watch. Learn Here

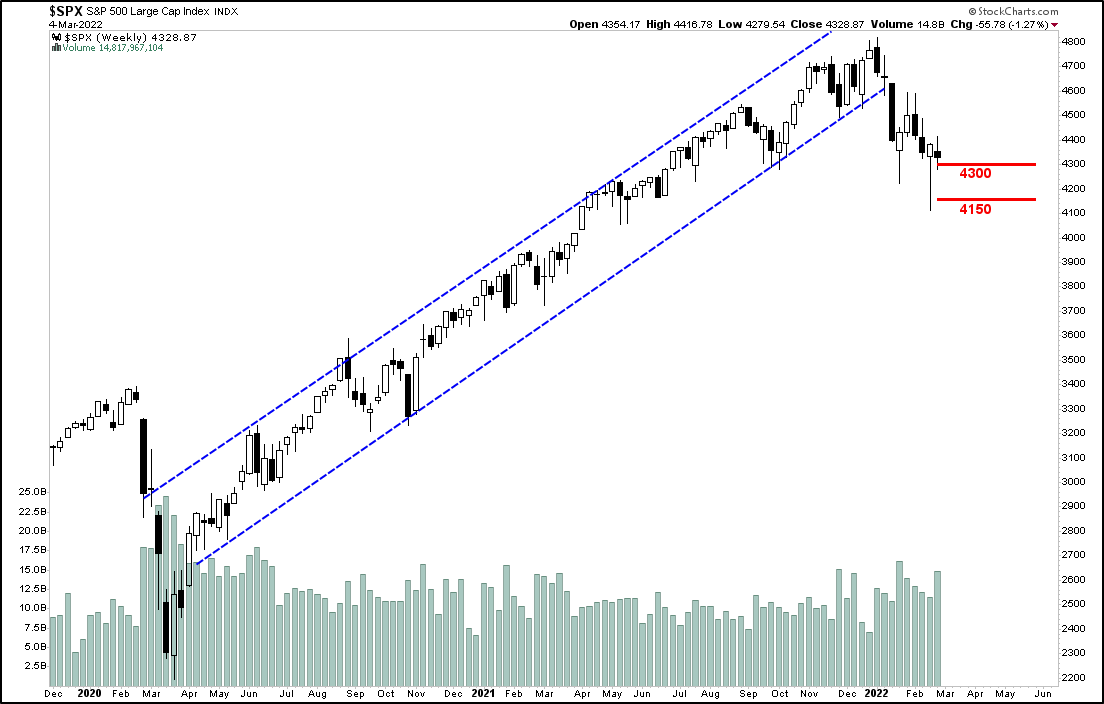

S&P 500 range is 4150-4300

Oil hit our $115 price target and touched $139. Don’t forget, the US can open the oil drills up in the sanctioned country of Venezuela if they NEED to.

Equity correlations head towards 1 in a sell off.

Want to watch: XME, REMX, RPV, NVDA, MSFT, GLD, SLV, ATVI, RBLX

VIX is still too high for no war. Add Nasdaq on serious weakness (-3%)

The funding stress indicator is getting wider. Keep an eye on this.

SPX will trade in a range

Oil hit our $115 target and $139 overnight.

We wrote about the Gold and Gold Vol trade back in January.

The Great Hedge.

The Germans gave back everything they made in the pandemic 2020 bounce…

The VIX is expensive, too high for too long.

VIX rule of 16

VIX consistently at +30 is too high to sustain. The rule of 16 is approximately the square root of 252 (the number of trading days in a year). When you divide any implied volatility (IV) reading (such as VIX) by 16, the annualized number becomes a daily number. Highest ever VIX was 80, it happened twice both in intense systemic events. THIS DRAWDOWN IS NOT A SYSTEMIC EVENT. With a VIX currently trading around 29, it is implying a 1.8% DAILY move in the S&P. That is too high to sustain which is why vol sellers are in control now and will push it lower into the week. Below is a table to help lay it out.

Still constructive on Bitcoin over all other digital assets. NEEDS to hold $35k

Return always wants its risk payment.

Not Investment Advice. For entertainment only.