Straight to the point alpha.

Now that the QQQ>XLE alpha is over. Focus on the rally about to happen in commodities (CANE, WEAT, SOYB & CORN), a weaker dollar and strong mega-cap | Chinese stocks (MSFT, GOOGL & KWEB). The VVIX is indicating VIX options are the cheapest in 2 years as we head into a volatile week.

Important notes:

Trading one asset class is basically trading blind.

A rollback of Chinese tariffs are around the corner. Here

The fed has "recognized the possibility that an even more restrictive stance could be appropriate if elevated inflation pressures were to persist."

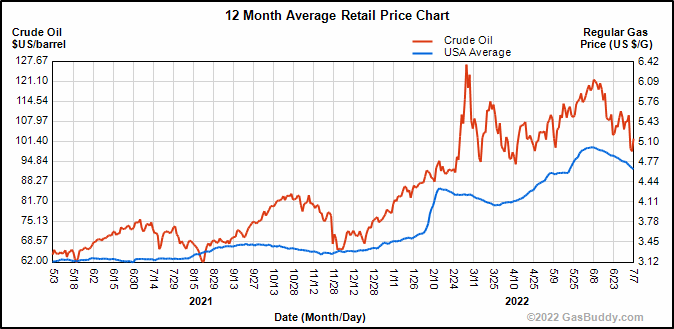

The weakness in yields, crude and copper shows recession is being priced in and we have entered into the demand destruction phase.

If you are not extremely passionate about the markets, go do something else.

Europe is getting trashed.

Fundamentals were always just a narrative.

Price action matters most.

Bitcoin is the only crypto and a true risk-on barometer for the markets.

Google: A great bullish engulfing candle on the chart. Don’t see those too often.

The US Dollar is weakening. A rally in commodities won’t help.

CANE: People are still stress drinking those coca-colas. Prepare for another leg up.

The commodity relief rally begins. A headwind for USD.

Gas prices are coming down. This is positive.

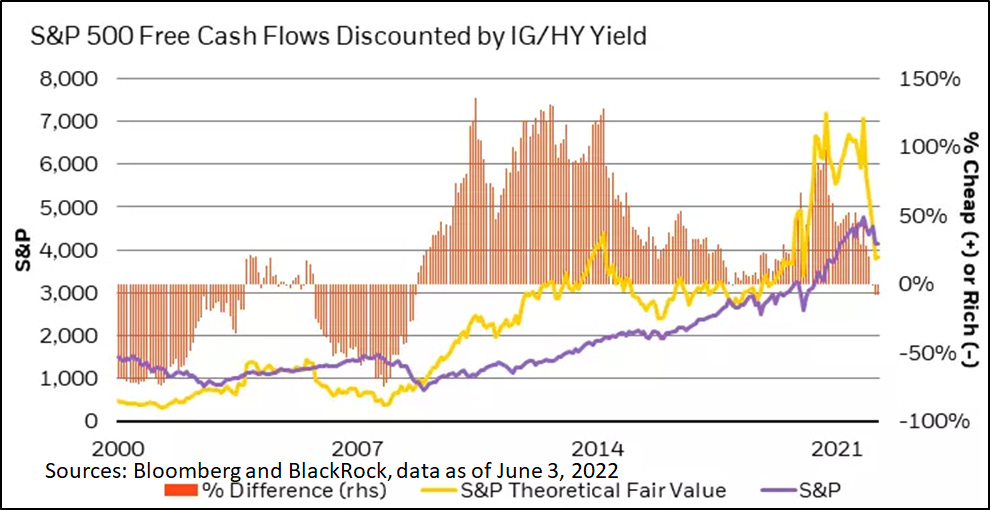

According to BlackRock, credit is starting to look attractive. We agree.

Relative rotation graph. Learn

An important Stanely Druckenmiller quote (he’s the best):

“Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

Return always wants its risk payment. Not investment advice.