Rate Hikes, Wars & Oil

The recent uptick in the long-end of the curve may deter further Fed rate hikes.

Support is at 351 for QQQ

War is likely to put a bottom in the price on oil, this will put pressure on US consumer (higher inflation = higher for longer rates)

AMD is starting to breakout on a relative basis.

2/10 curve continues to un-invert rapidly, flashing recession warnings

Follow us @ gmgresearch

Near the QQQ volume area.

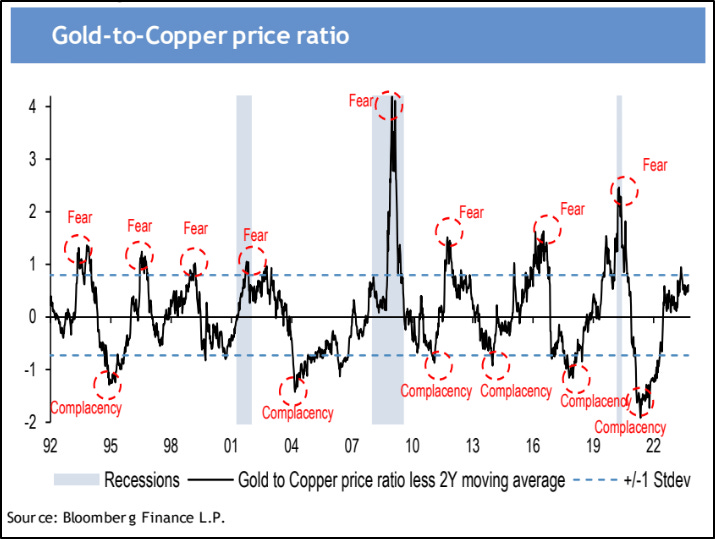

Copper and global growth outlook weakening.

High yield spreads aren’t blown out yet (not enough panic)

BAC: New multi-year relative low. Rather own Bitcoin.

Fear is coming back. Gold bid since this turmoil started.

AMD is looking good here still with the fresh relative breakout. We like ASML too.

TLT: The real bear market has been in bonds. Down 49%

Illiquid markets: Flesh and Blood Sealed 1st Edition Boxes