Quick market update.

The biggest risk is still growth over inflation.

Curve continues to steepen

Energy sector is about to turn around. (XOM)

Iren and Applied Digital are looking a little toppy.

Silver will continue to outperform (photovoltaic sensors in solar panels)

The Chinese breakout was real

Consensus trades - short USD & steepeners are starting to become overcrowded, look for a rebound. Positive momentum in equities are driven by AI-driven animal spirits, another dovish Fed pivot, an expanding global money supply, and upward earnings revisions.

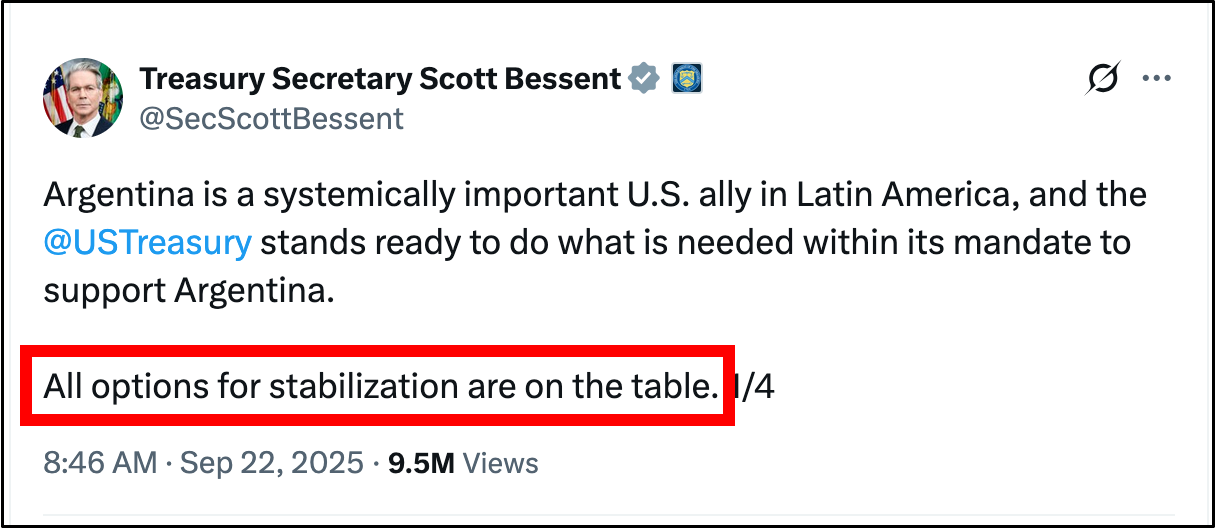

IMPORTANT: The US government is openly looking to buy stakes in public companies that they consider vital for success. This action is unprecedented and is not being discussed like it should.

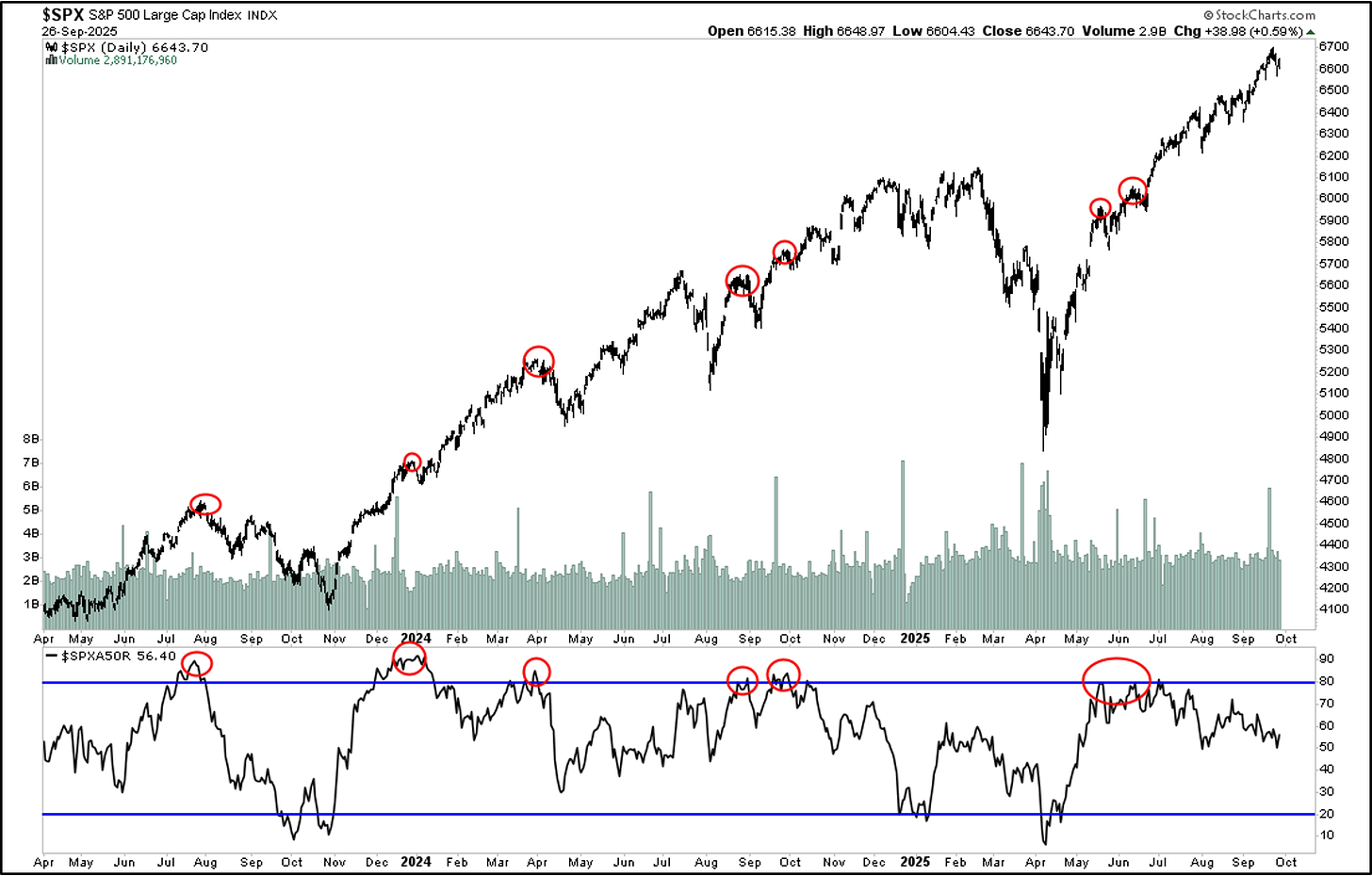

S&P is not overextended.

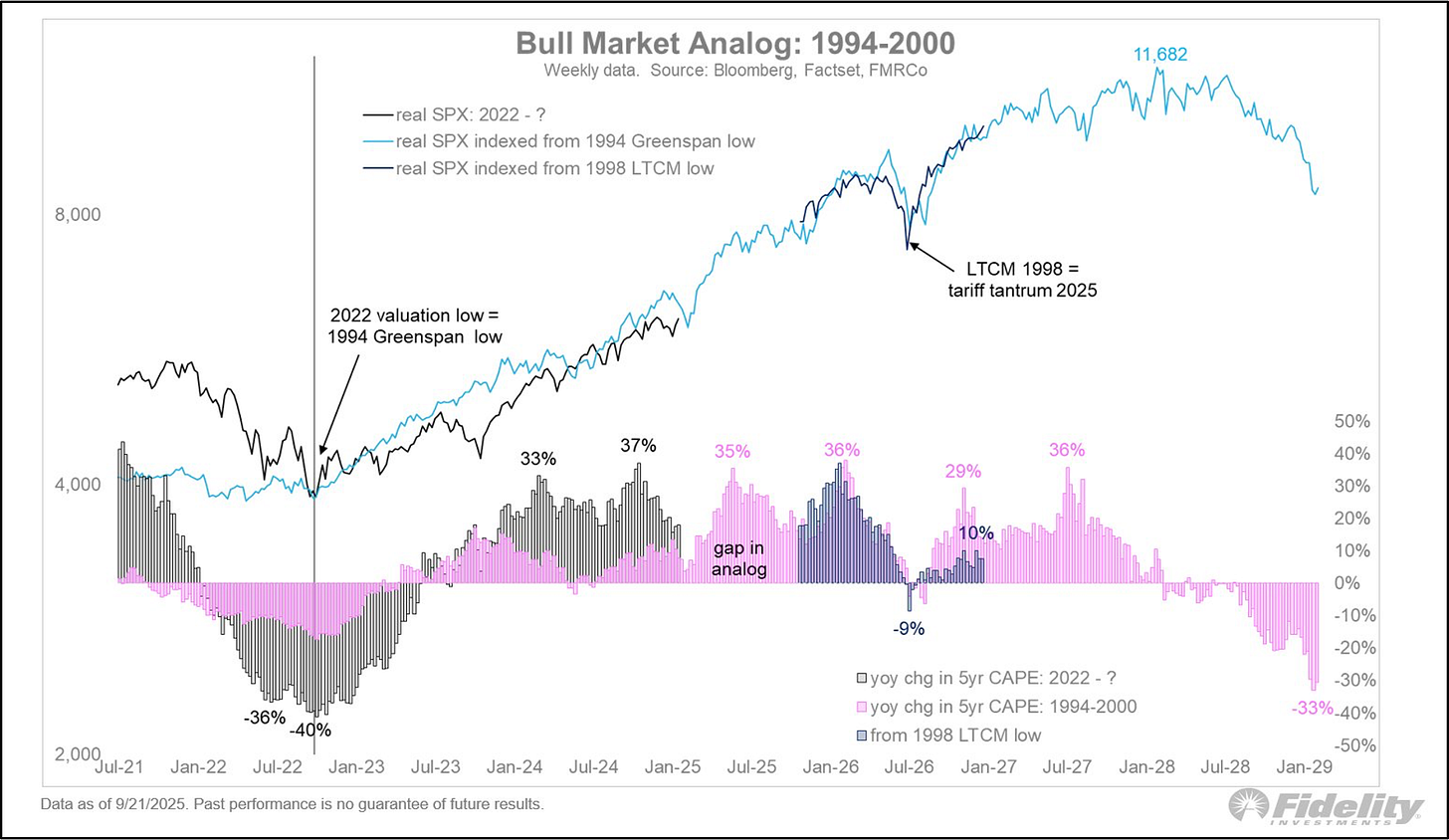

Fidelity believes this rally is similar to 1994-2000 where the Fed cut interest rates into a rally following a tightening cycle.

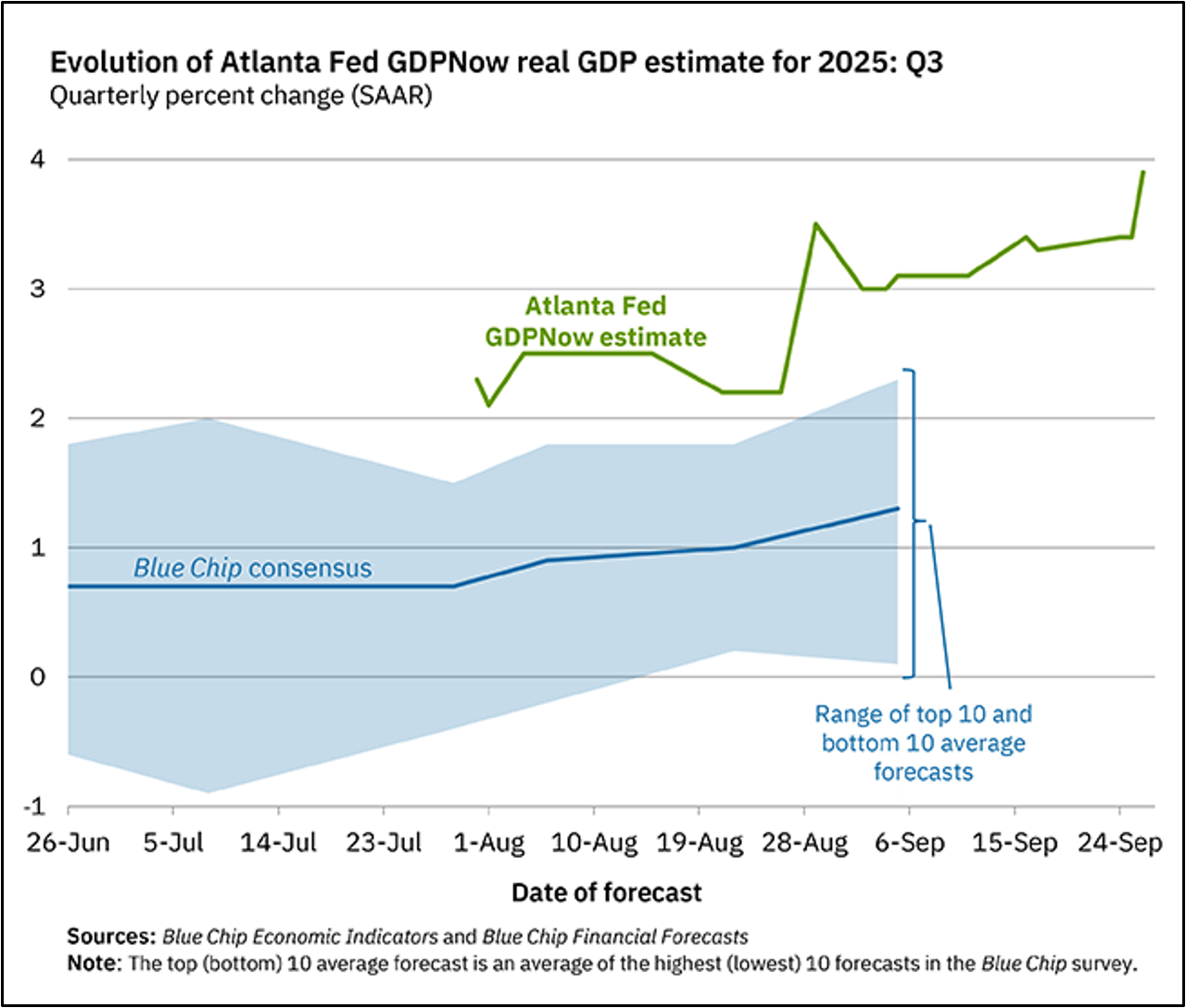

GDP Now forecast moves up to 3.9% for the quarter.

Read the tweet below then look at the Argentina ETF. Once the US gov steps in maybe it’ll be something to consider.

AMD holding up very well after the NVDA/INTC deal…

Keep reading with a 7-day free trial

Subscribe to GMG Research to keep reading this post and get 7 days of free access to the full post archives.