Markets are close to a technical bottom – corrections typically end on bad news, not good news.

Our research is now read in 61 countries.

Updated: Big Story To Monitor

Media outlets will amplify the “recession” risk due to sharp government spending cuts—but this is actually a positive. Don’t fall into the fear. Embrace the dip as an opportunity, as it gives the Fed cover to cut rates once or twice more this year.

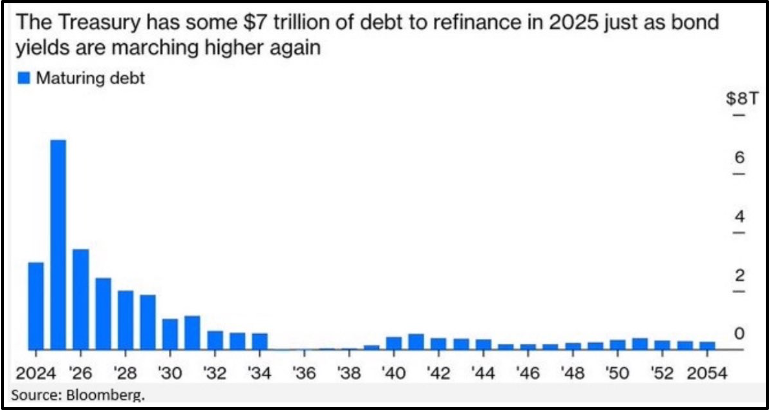

Trump wants lower rates because over $7T in treasuries are maturing this year (scroll down for chart). This explains why bonds have been rallying for the last two weeks.

Markets are close to a technical bottom – corrections typically end on bad news, not good news.

Odds of a May rate cut are skyrocketing.

Industrial metals are turning up (Iron, aluminum, copper)

USD is weakening.

Technology relative to the S&P peaked on July 10th, coinciding with the USDJPY peak. Yen strength is notable.

Backwardation in the VIX curve is showing signs of a tactical low in the market.

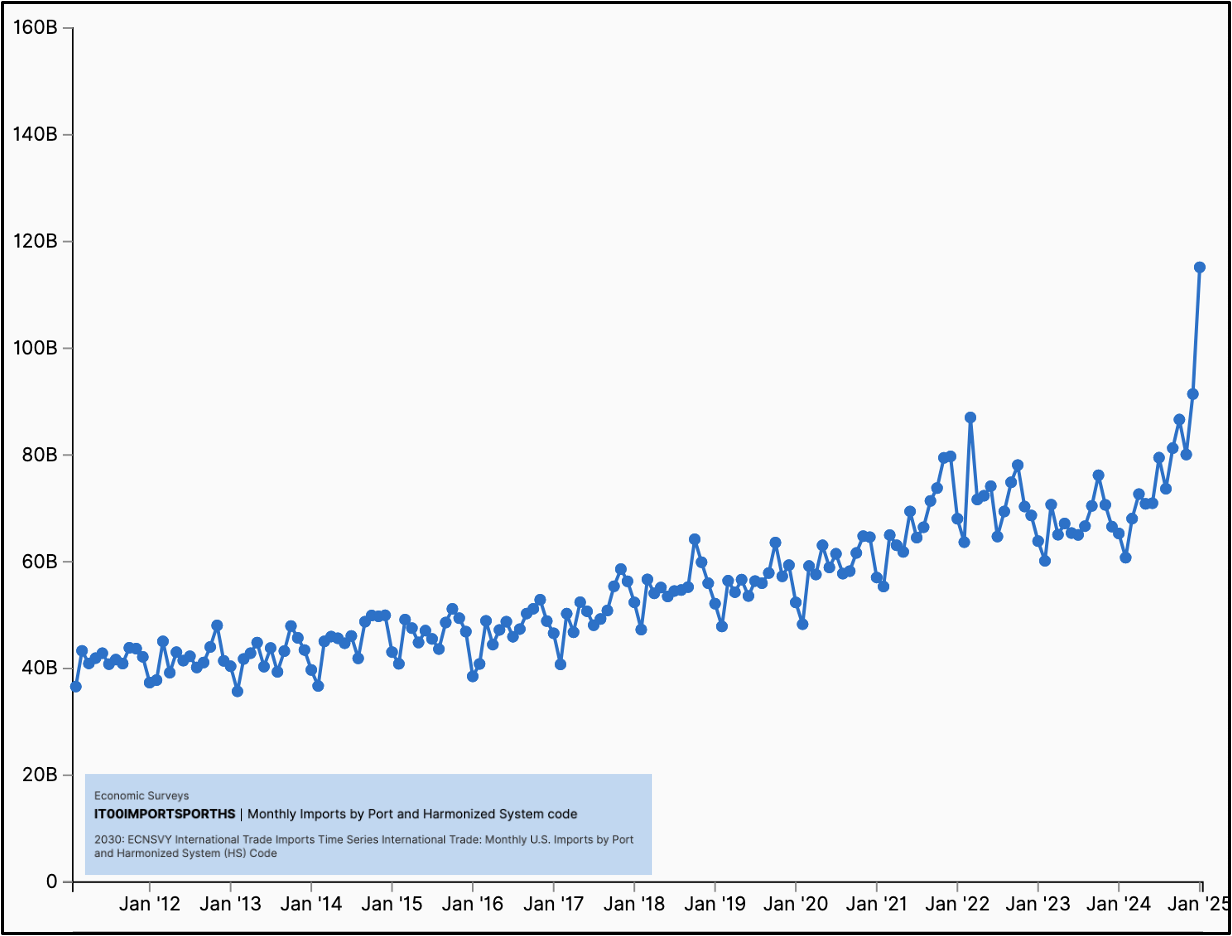

Front-running supply before the tariffs will hit PPI numbers.

$7T in treasuries maturing this year. Trump wants lower rates before this happens.

Updated chart: Important levels for Nvidia.

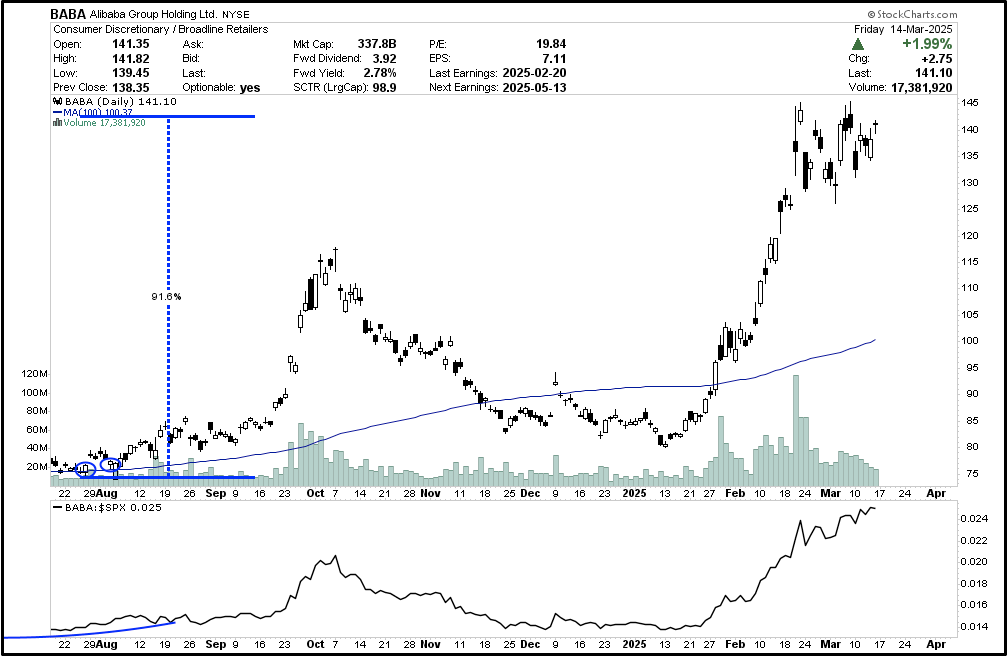

Tencent: We were pounding the table on Chinese tech back in the summer.

Same with Alibaba.

Look at this M1 chart. China is going higher.

Imagine investing in small-caps with a straight face. Next time you look at your “advisor’s” statements, see how much of SC you hold.

Long Meta / Short Apple has continued to be our best pair trade in years.

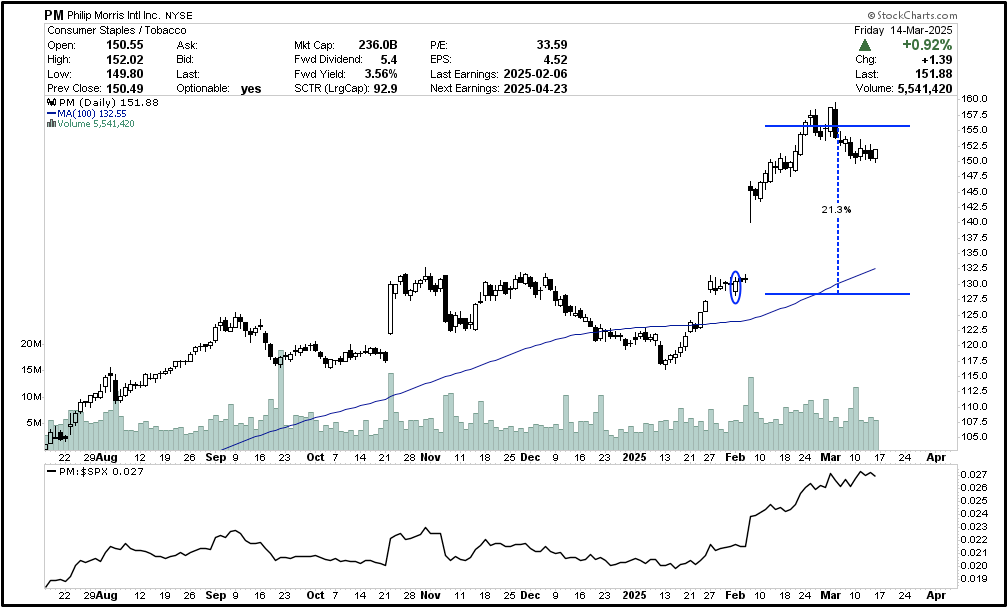

We continue to like Philip Morris. Still pays 3.6%

Palantir’s uptrend is intact.

In August: “Counter-Strike skins are going to continue their strong performance, great assets.”

The CS skin market has hit an all-time high, surpassing $4.2B in market cap.

Look at this chart. More functional utility than 99% of crypto assets.