Look beyond equity markets.

There is a greater chance of the fed becoming incrementally more dovish in the intermediate term rather than more hawkish.

We would appreciate to hear your questions or feedback. Email us at gmgmacroresearch@gmail.com

Equity futures look to be fading into the night and important levels to have been breached: S&P 4400, QQQ 350, AMD 100. It is important to understand the controlling narrative of the market: Energy/commodities/resources need to peak and China’s supply chain issues need to settle before the bond market can stop free-falling.

Expect more heightened volatility, BUT…

There is a greater chance of the fed becoming incrementally more dovish in 6-9 months rather than incrementally more hawkish. (A positive for equities)

Fundamentals were always just a narrative. Price action matters most.

Fresh relative lows for Microsoft and Nvidia. Most people are shitting bricks. An opportunity there.

Sentiment is at multi-decade lows (way too low), the AAII bullishness sentiment survey is at the lowest level since 1992 here.

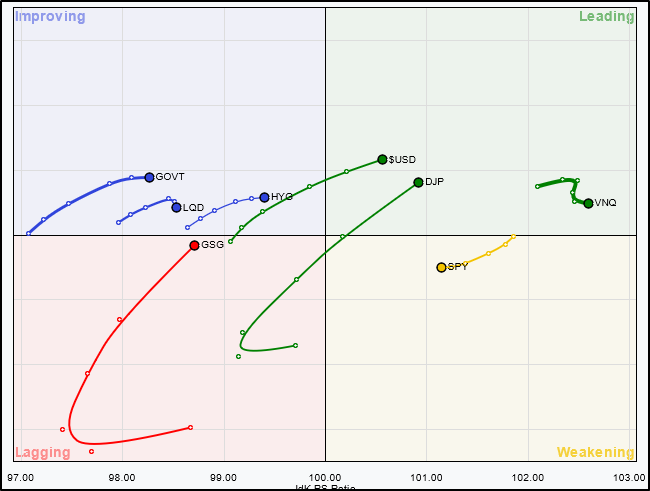

Watch the performance: GSG, GLD/SLV, HYG, TLT, EWZ, QQQ, GLD, STIP, WMT, QUAL

This chart has been up since January.

Gold is still strong

GSG is coming back for vengeance

We were bullish GSG last week (+6%) in weak markets

AAII survey bullishness declined to the lowest level (15.8%) since 1992. 12m forward returns are typically+++

Return always wants its risk payment. Not Investment Advice.