Key Opportunities & 12 Charts That Matter

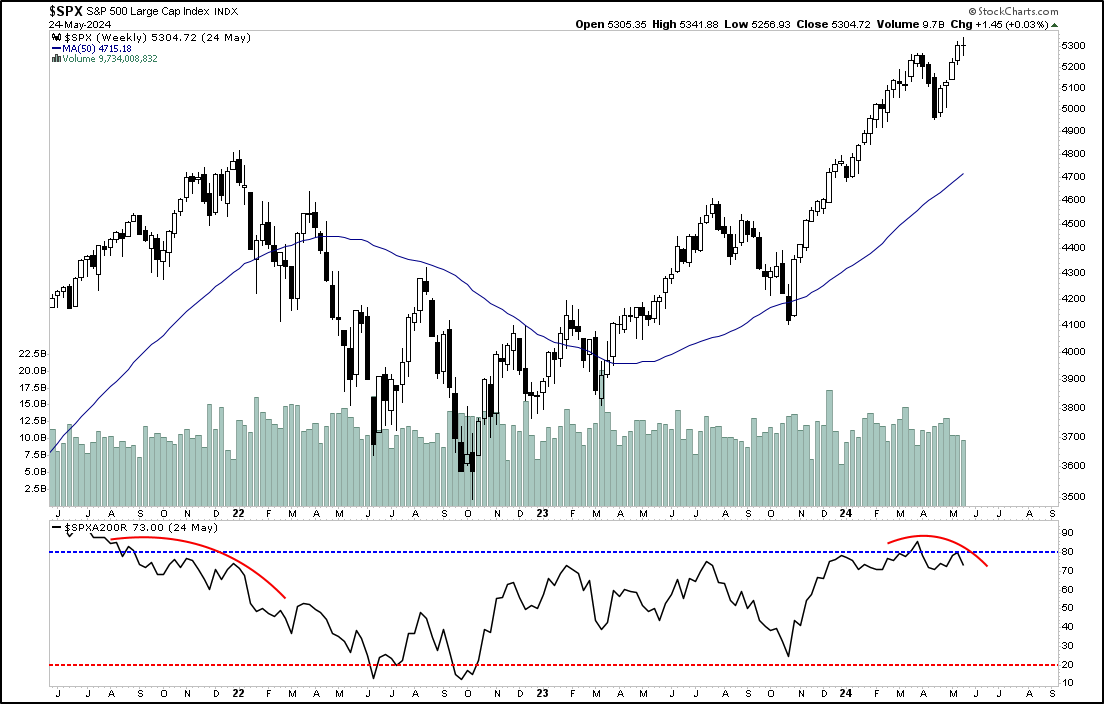

% of stocks above the 200ma is high and deteriorating.

₿itcoin will continue to lead ALL RISK-ON ASSETS.

Copper is essential for electricity generation, storage, and the AI transition. However, the current supply is inadequate to meet future demands, requiring a 115% increase in copper mining over the next 30 years. Even Stanley Druckenmiller says copper is a great bet for the next 6 years because EVs, data centers, and missiles all depend on it. Read more here.

Use weakness in Copper as an opportunity. Long-term play.

Basic info on relative trades.

Chinese tech trending higher. China will circle Taiwan until they tell America “we are with them now”. Chinese megacap tech stocks are undervalued with P/E ratios below 10, despite strong fundamentals and earnings growth comparable to US tech, due to perceived government interference risks. Companies like Temu, Shein, and Tencent are also gaining significant popularity in the West so its not a pure China play anymore.

AMD higher. Pay attention to the Microsoft partnership.

The arrival of intelligence in a non-human form is a big deal.

If you actually believe in fundamentals still, Nvidia is historically underpriced. The stock’s FWD P/E multiple remains below the 5-year average.

Credit delinquency rates are at their highest since 2012.

McDonalds needs to lower their prices or see their stock price fall more.

All these calls are trash besides two. Mizuho and Societe

Reserve list MTG: Illiquid “security” that hasn’t gotten the attention it deserves recently. Higher in the next 3 years. Most likely will beat the S&P too.

Return always wants its risk payment.

NOT INVESTMENT ADVICE. Only for entertainment.