GMG Weekly

The VIX hit pre-covid lows last week. Just in time for the rotation into commodities/energy.

Bitcoin: BlackRock and Fidelity both file for SPOT Bitcoin ETFs (Important)

US Dollar denominated Bitcoin needs to win amongst all else if the US is going to keep the crypto eco around.

SBF is still leading the demise of Binance behind the scenes.

China central bank cut benchmark lending rate for first time in 10 months

Taiwan: US Secretary of State Blinken says Washington does not support independence for Taiwan (huge news)

Japan hits new 52 week highs, use upcoming weakness as opportunity.

According to Goldman: “We saw L/O buy programs back in cyclicals in good size today w/ significant buy tickets in energy and materials.”

Coupang!

Commodities are starting their move higher.

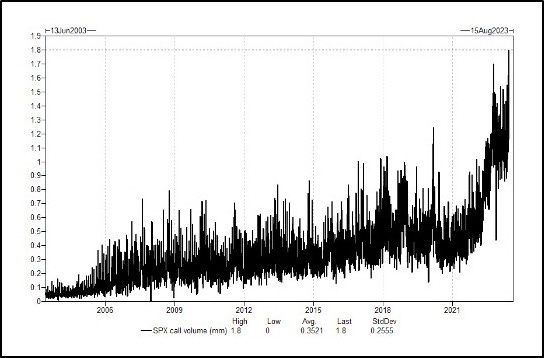

Call volume is at all time highs. The juice is not worth the squeeze.

Japan hits new 52 week highs, use upcoming weakness as opportunity.

Some BlackRock insight. Don’t follow the herd.

The relative rotation graph

Return always wants its risk payment. NOT INVESTMENT ADVICE.