Fear Is The Opportunity

Follow us: @gmgresearch

Quick Takes:

Last week’s “Use fear as opportunity” email validates that timing is everything.

Equity markets are near a short-term low. Watch mega-caps lead.

The average inflow price for the S&P since Nov 2020 is around 4160.

Inflation already peaked.

Crypto is hanging on for dear life. Nasdaq needs to help pull it up.

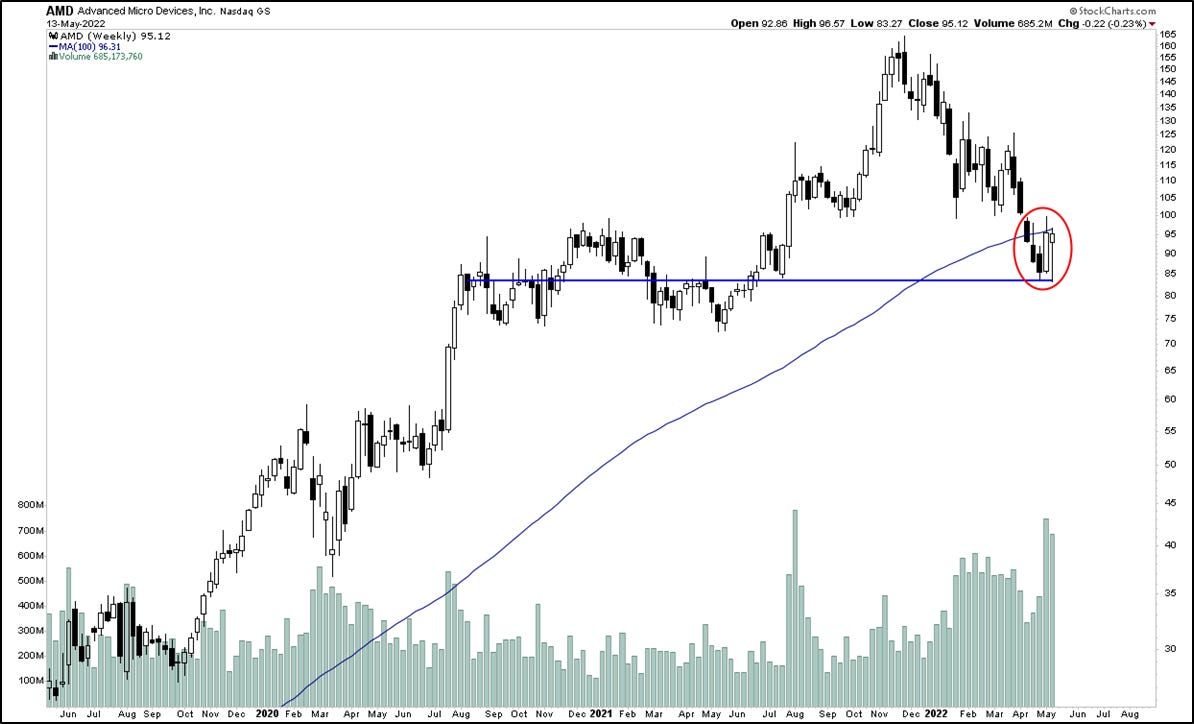

Semiconductors are starting to outperform. (AMD, NVDA)

China’s economic data overnight was trash. Can only get better

Retail sales fell 11.1% vs the consensus estimate of 6.6%

The unemployment rate climbed to 6.1%, just shy of the 6.2% unemployment rate during the peak of the covid crisis.

What to watch: AMD, NVDA, XLY

Remember, there is a greater chance the fed becomes incrementally more dovish than hawkish in 6-9 months. (Bullish) The fed already denied a 75bps hike just last week.

S&P 500: The % of stocks above their 50ma is starting to show a bottom. Still hovering around 4000.

AMD: Outperforming during the fear last week. Risk/return is solid once it closes above $100.

Great support for Nvidia

No liquidity in the market. Only $2.1M at the top of the book. Below the 1%-tile

USD Continues to rip higher, helping the fed hold down the costs of imported goods. Can you imagine if the USD was weakening this whole year? There would be Chaos.

Remember: 12m returns after VIX spikes to 35+ are 20%+

Return always wants its risk payment. NOT Investment Advice.