Everyone is hedged for a crash. Watch the VIX and real yields.

Curve flattening: The tightening cycle begins in an already slowing economy. VIX at 29 is not sustainable. Banks are making outrageous calls on rate hikes. QQQ will outperform most asset classes.

Quick Take:

Real yields are the main threat to the QQQs. If they stabilize, bullish for QQQ.

QQQ will outperform the S&P in the intermediate term if real yields stabilize.

The line in the sand for S&P is 4340 or 6% lower around 4200

Bitcoin is still holding up and trying to base, it’s the true risk-on barometer.

Markets are over-hedged and VIX is too unsustainable high (30), high levels of vol tend to collapse under its own weight. (see lesson below)

Hike expectations are way too hawkish and need to come down.

Outrageous calls by big banks on the amount of rate hikes to come:

• JP Morgan: 5 hikes this year (Mar, May), 3 next year

• Bank of America: 7 this year (every meeting), 4 next year

• Morgan Stanley: 4 this year (Mar, Jun)

• Deutsche Bank: 5 this year (Mar, May, Jun), 3 next year

• Goldman Sachs: 5 hikes this year (Mar, May, Jun), 3 next year

The data from last week was not “good news” for the economy but positive for less rate hike expectations. Personal income and spending were down. Fed manufacturing indices dropped. Retail and wholesale inventories rose.

Curve flattening: The tightening cycle begins in an already slowing economy.

VIX rule of 16

VIX consistently at +30 is too high to sustain. The rule of 16 is approximately the square root of 252 (the number of trading days in a year). When you divide any implied volatility (IV) reading (such as VIX) by 16, the annualized number becomes a daily number. Highest ever VIX was 80, it happened twice both in intense systemic events. THIS DRAWDOWN IS NOT A SYSTEMIC EVENT. With a VIX currently trading around 29, it is implying a 1.8% DAILY move in the S&P. That is too high to sustain which is why vol sellers are in control now and will push it lower into the week. Below is a table to help lay it out.

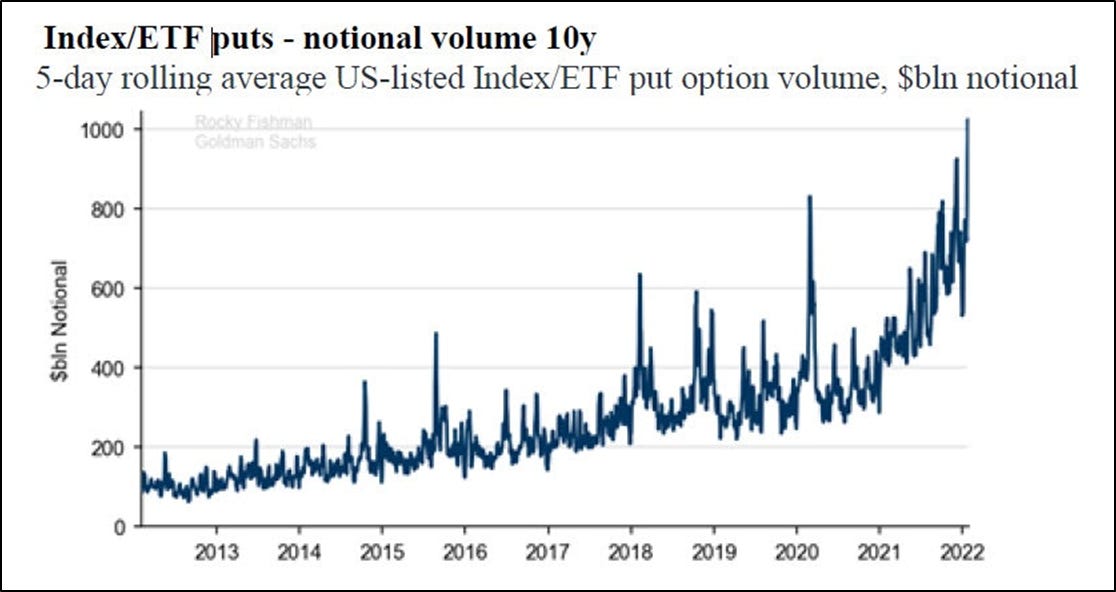

Everyone is hedged for a crash: "we have been averaging $1 Trillion worth of puts per day. Largest on record." - Goldman Sachs

Most important chart to understand: Real yields = real problems for the QQQ.

S&P starting to carve out a bottom.

Fundamental investing was always just a narrative. Not Investment Advice.

Hi - appreciate your work and I'm paying attention...plus I'm short premium so VIX going down is confirmation bias music to my ears!

Thanks

TK1

ps: FORG Jul 25/35 Bull Call on my books for .80