Coordinated Central Bank Action

GOOD NEWS. Our macro & multi-asset approach has allowed us to navigate the turbulent market conditions of the past year with exceptional success. As a result, our subscriber base has expanded significantly, growing by an impressive +760% and reaching 81 different countries!

By focusing on a range of assets across different markets, we have been able to mitigate risk and capitalize on opportunities, while our macro research has provided a deep understanding of global economic trends and potential market shifts.

We are proud to have built a subscriber base that spans across diverse regions and cultures, and we remain dedicated to delivering exceptional value to all of our subscribers.

Paywall is coming.

MOST IMPORTANT THING:

“Coordinated central bank action to enhance the provision of U.S. dollar liquidity” (Basically everyone needs dollars and the fed is right there to the rescue). The fed did this in covid 2020, aka “the rip your face off rally”. Link Here

Now for the quick points:

The pitch for Bitcoin & Gold is there… If the Fed pivots too early and turns dovish into a high inflation scenario, it would be bearish for USD thus helping bid BTC & gold

QQQ to $320 & BTC to $30K

QUAL>SPY

Swiss National Bank is in BIG trouble. The US will come to the rescue for peanuts. Link Here

Fed balance sheet soars by $300BN as Fed is back in the bailout business.

Remember… Trading one asset class is trading blind.

Last week we said to watch for the rally in Bitcoin, Nvidia& Google. Below is the performance from last week.

QQQ to $320

QUAL>SPY

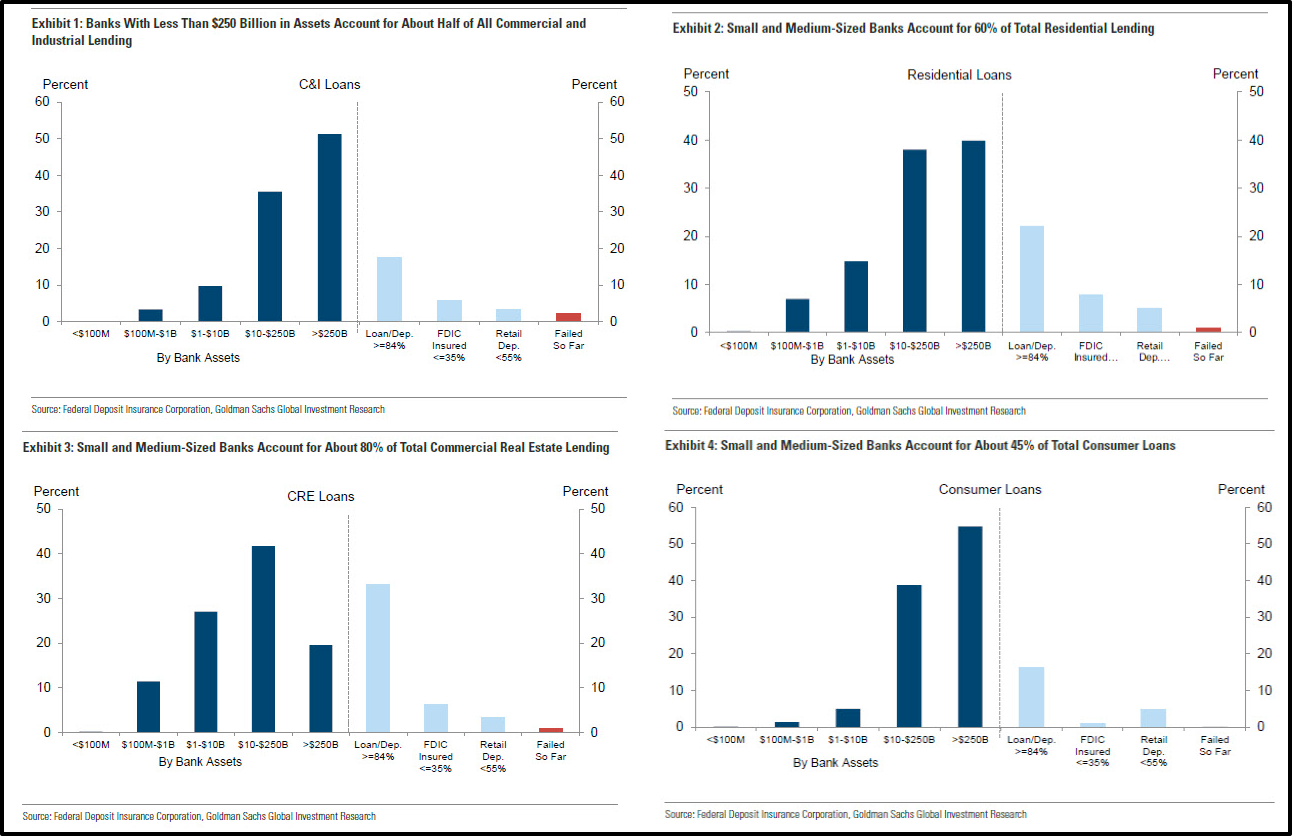

Small/medium banks account for 60% of residential real estate lending & 80% of commercial real estate lending. Help in the sector is needed.

Crisis in FRA-OIS too.

The Fed had to step in already and erase 50% of their QT balance sheet progress in one day.

Fed became a lender of last resort to other central banks during Covid 2020 and no one is talking about it. Very Important. HERE

Return always wants its risk payment. NOT INVESTMENT ADVICE