A Hard Landing Scenario.

Send your questions for next week's email to gmgmacroresearch@gmail.com

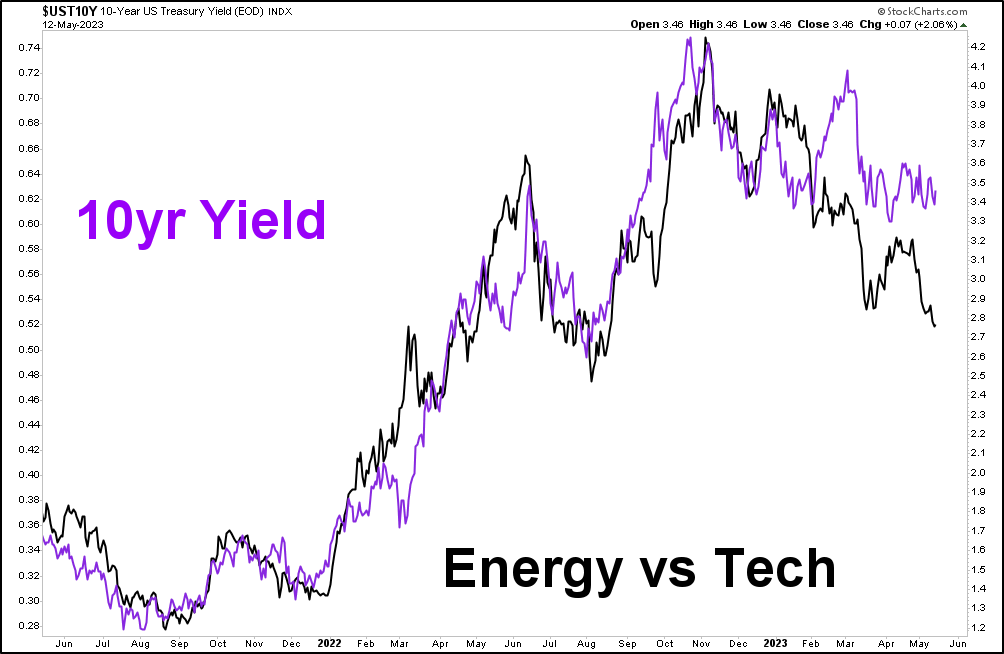

Watch out for a rotation out of the broader market into ENERGY & GSG

An unlikely debt ceiling crisis would trigger major market shifts.

Regional banks' exposure in commercial real estate and offices will be a potential vulnerability in a hard landing scenario.

Newcrest (huge copper miner) backs Newmont's $17.8B offer following Druckenmiller's remarks on copper's tightness. Look at further weakness as opportunity.

Precious metals like gold and silver, typically underperformers in hard landings, could defy historical trends due to the rise in EV and infrastructure demand, as well as the challenge from BRICS to USD.

Contrary to the 2008 crisis, a shortage of single-family homes persists despite housing sector declines. Past market shocks have led to sector rallies post hard landings.

Despite potential short-term adversity, a hard landing could stimulate creative destruction and recovery, echoing the post-Volcker era in 1982.

Watch out for a rotation out of the broader market into ENERGY & GSG

Return always wants its risk payment. NOT INVESTMENT ADVICE.